Rent or Buy? Run The Numbers, They Say…

Buying a home has always been a part of the American dream. But, in recent years, that “wisdom” has come into question.

With interest rates and home prices both rapidly rising, homeowners who bought during COVID with low rate mortgages have little incentive to sell and move. Many bought their dream homes, when the prospect of ongoing lockdowns and spending the foreseeable future at home was a reality. They have low payments and tons of equity, so moving has to be enticing, leading to a shortage of choices and bidding wars.

So how do you decide?

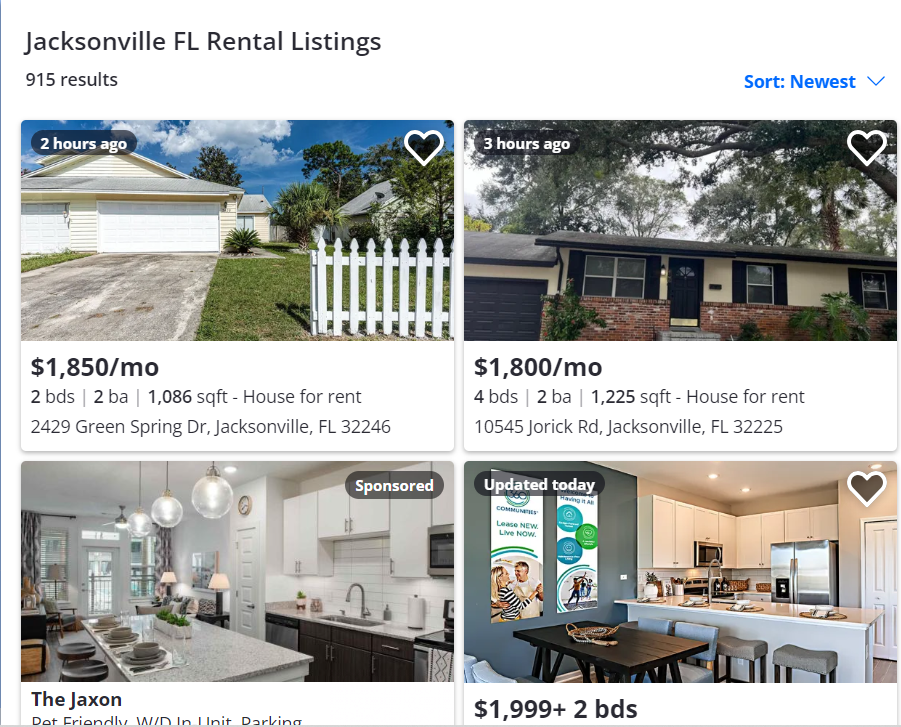

Once you know your budget, where you want to live and what type of property you want to live in and how long you want to be in the next place, let’s begin by researching the rental rates for something comparable. A common misconception is that rentals are mostly condos and apartment buildings. A quick Zillow search and filter will show you almost every type of property is available for rent, even if you want a house with a yard and a pool.

You then compare this to a mortgage for a comparable house, to see if investing the difference would yield better results.

Time for a real world example

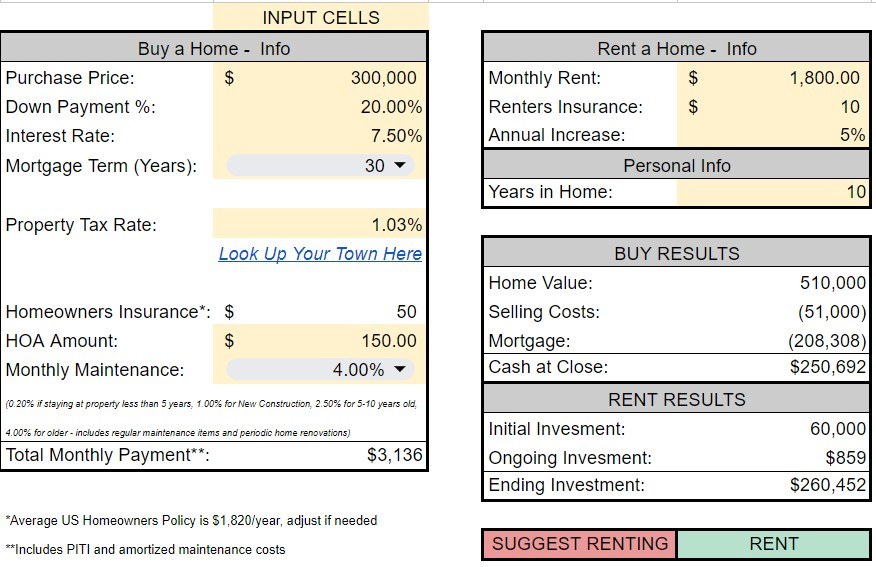

For our example, we are going to look at a couple searching for their next home in Jacksonville, FL. They are looking for a 2 bed, 1 bath with a yard for their dog and think they’ll live in their next home for around 10 years.

The Rental Scenario

A quick search shows rental rates for properties that fit their criteria are around $1,800 per month, which is the most they can pay (plus about 3-5% increases annually throughout the term). Add to this about $10 per month for renter’s insurance.

The Buying Scenario

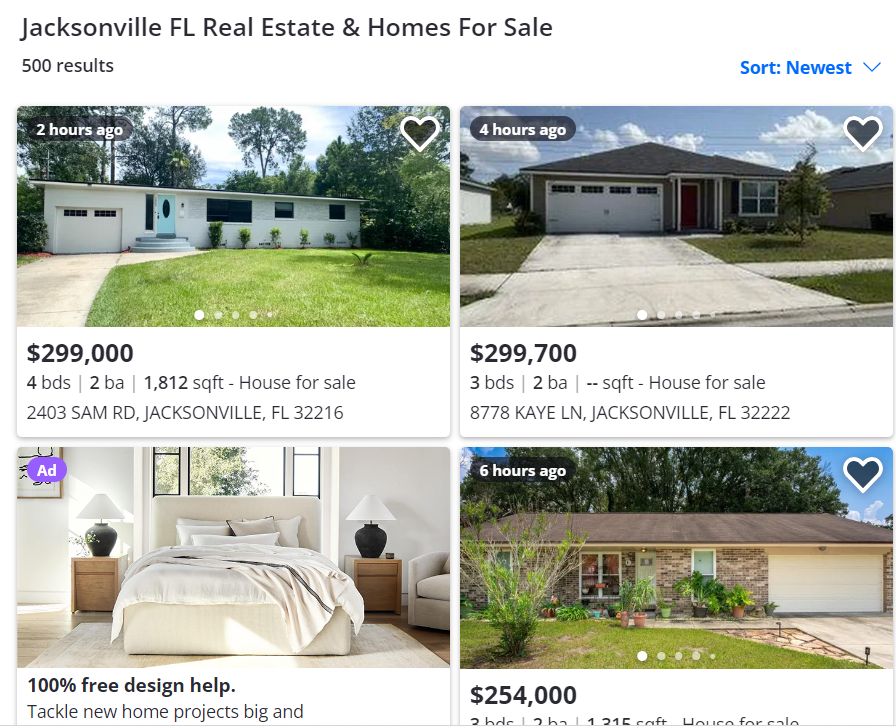

Ok, now let’s find out how much a similar home would cost them to buy, hold for ten years and sell.

So, homes that meet their criteria sell for around $300K. Property taxes are estimated to be 1.03% of sales price. Assuming your taxes never go up, lol, your mortgage payment would be around $1,950 per month.

But you’re not done yet. To this you need to add homeowner’s insurance, outside maintenance (like landscaping, roof and siding), indoor maintenance (like floors, appliance repairs etc), water/sewer, garbage pickups and general upkeep including renovations (either for you to enjoy or for the next person as you prep for sale). All said and done, the real monthly payment would be something like $3,100.

So let’s compare results

So the total cost of homeownership in year one is almost $1,300 over renting. But, to be fair, your rent will increase, so on average over the course of 10 years, you’ll have $850 to invest each month. And don’t forget the $60K down payment you made.

In aggregate, the amount of savings each month from the rent plus the initial down payment, growing at around 7% per year you would have around $260K in an investment account. Not bad for “paying somebody else’s mortgage.”

Now let’s compare this to a home purchase. At the end of the 10 years their $300K home would now be worth $510K! Over the same time you would have paid down your mortgage by $32K, leaving a balance of $208K. Ok so let’s sell this house and see which one worked out better.

When it’s time to sell, you’ll have to pay your broker, title company and government transfer taxes. This is typically around 10% of sales price, or in this case $51K. After paying off the mortgage, you are left with $251K! Again not bad, but $9K less than if you had invested the down payment and each month’s savings.

So should you rent or buy?

In this case, the calculations showed renting was a better option. But this could have been different if they were staying their longer, or found a cheaper or newer home. There are many variables that are different for each of us, but best way to do it is to run the numbers for you and see what works out best.

If you want a copy of the Google Sheet displayed in this post feel free to get in touch with me and I will grant you access to the community version.