Unveiling the Illusion: Why Passive Investments Aren’t Truly Passive

So you’ve got a little extra cash?

You are likely a mid-senior level manager who has worked hard, invested diligently and are now in a place where you can look forward and begin to plan your future. You begin to do research and learn about the 4% rule and based on your calculations you’ll need about $3 million invested to generate $120,000 in pre-tax income in retirement. You check your 401K balances and realize that if you max out each year and add Social Security income you’ll still need to work until your 67 years old. This can’t be life.

Multitasking is a way of life and time is your most precious asset. With a demanding job and young family, there is no time for additional investments, but you’ve finally got some extra cash, and EVERYBODY knows “Cash is Trash.”

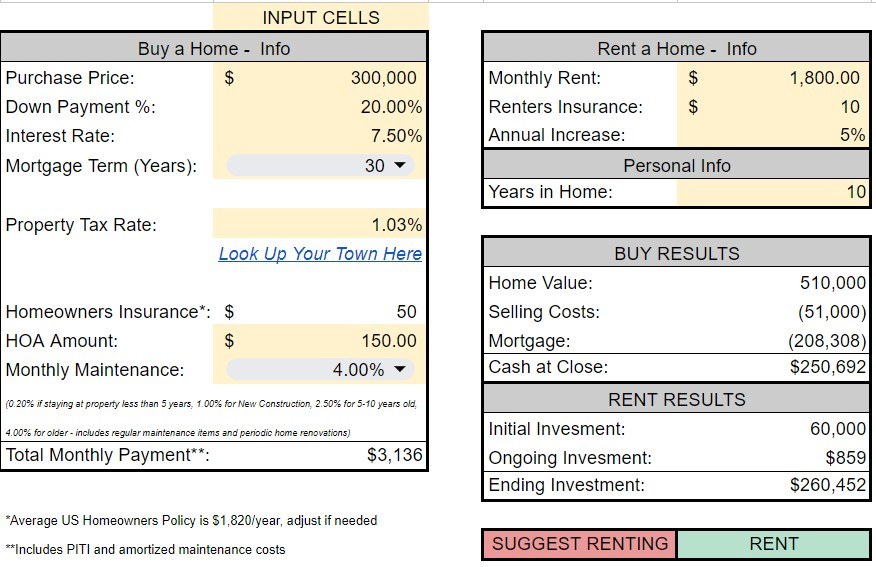

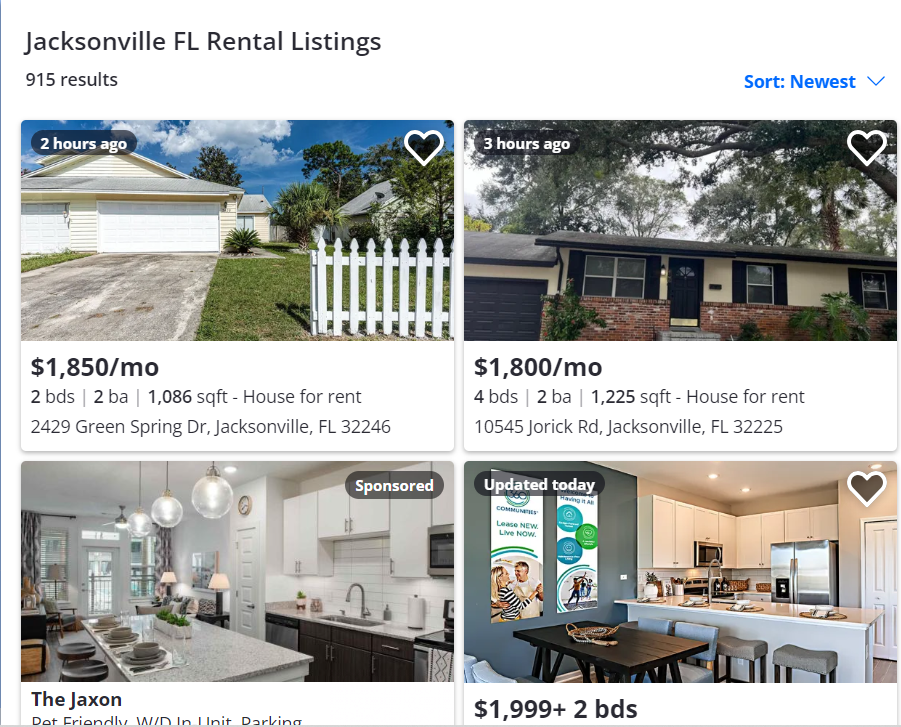

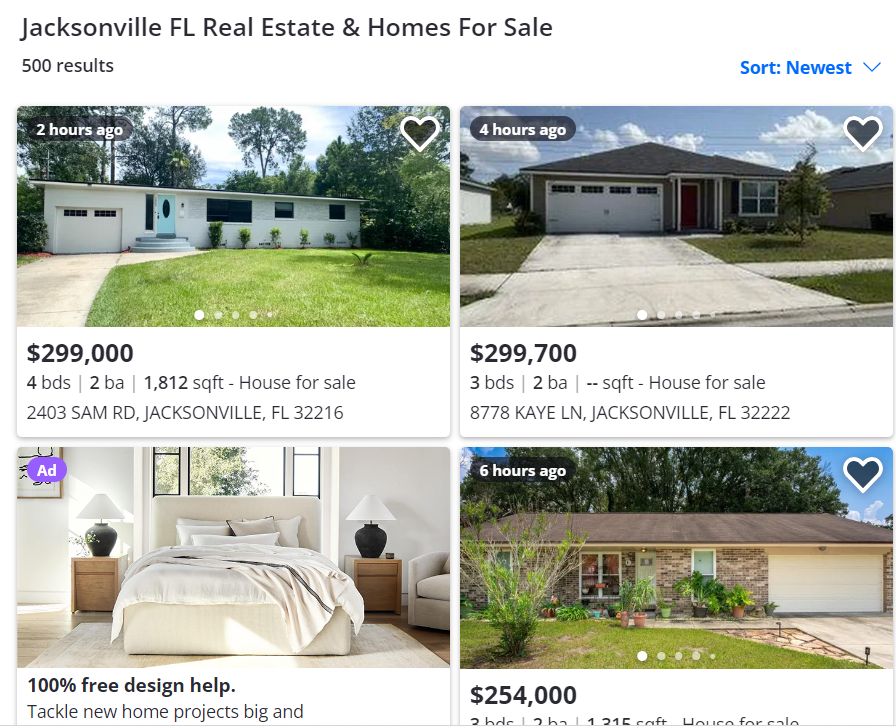

Enter passive investments. An investment that you don’t have to actively manage yet still generates cashflow and appreciation? Sign me up! At this stage most people turn towards real estate, dividends or some sort of syndicate.

The allure of earning returns without actively managing or frequently monitoring them seems undoubtedly enticing. However, there is a hidden truth that often goes unnoticed – passive investments, in reality, are not entirely passive. This article dives deep into the notion that even the most seemingly hands-off investments, even financially lucrative ones, require mental space, emotionally connecting investors to their investments. Let’s explore why the concept of “passive” holds an elusive grip on our financial pursuits.

The Myth of Passive Investments

When we hear the term “passive investment,” we might conjure images of hassle-free financial gains with minimal effort. However, the truth is that these investments, while certainly less demanding than active strategies, still command attention and mental space.

The Perceptible Benefits of Passivity

Investors are often drawn to passive investments due to the perceived benefits they offer. These include lower fees, reduced time commitment, and the ability to mirror broad market performance. While these advantages are certainly attractive, they do not come without hidden costs.

The Psychological Burden of Passive Investing

Despite their name, passive investments subtly occupy our mental space by instilling emotions that can influence our decision-making processes. Here are a few ways in which the myth of passivity collides with emotional involvement:

- Emotional Connection:

Even though passive investments lack active management, investors tend to develop an emotional attachment and sense of ownership. This connection becomes apparent during times of market volatility or external events influencing investment performance. For example, owning a Florida home that you seldom visit might still trigger concerns over its well-being during a hurricane, impeding true emotional detachment. - FOMO and Information Overload:

Passive investors may often wrestle with “Fear of Missing Out” (FOMO) in rapidly changing markets. Though they might resist the urge to act, being inundated with news and updates can fuel anxiety and a compulsion to monitor financial developments constantly, disrupting the notion of passivity. - The Paradox of Choice:

The wide array of passive investment options available today can be overwhelming. Deciding on the right asset allocation, geographical exposure, or thematic focus can cause decision paralysis. This mental burden detracts from the notion of passivity, as investors grapple with the responsibility of choosing the “right” passive investment strategy. - Managing the Manager:

While many operators are skilled, there are many that are not. To find out the difference, you will have to spend a considerable amount of time sifting through reviews, doing interviews and your own diligence online. Even with this, you are not sure to find a great manager of your investment, but even if you do, you will still need to speak to them on a regular basis to get business and financial updates. - Company Financial Statements:

While your investment may be managed passively, your taxes are your responsibility. One advantage that is widely discussed is the tax benefit of owning your own business. But to take advantage of these, you must track your expenses diligently and separate between personal and business expenses. You must maintain proper books and file separate taxes. This all comes with additional time or investment in a great CPA and bookkeeper, which is highly recommended.

Navigating the Fine Line Between Passive and Active Engagement

While passive investments may never truly offer complete detachment, certain strategies can help investors strike a balance and mitigate the psychological burden associated with them:

- Adopt a Long-Term Mindset:

Embracing a long-term perspective helps investors weather short-term market turbulence without succumbing to emotional decision-making. Building a well-diversified portfolio based on personal financial goals and risk tolerance can reduce the compulsion to actively monitor investments. - Set It and Forget It, a stock market strategy:

Automating investment contributions, which increase with salary and bonus increases, and rebalancing can minimize the need for constant tinkering. Establishing a disciplined approach through automatic transfers and portfolio rebalancing ensures that investments are free from reactionary adjustments driven by emotion or market noise. - Practice Mindful Information Consumption:

While staying informed is vital, investors should be mindful of the information they consume. Limiting exposure to financial news and adopting a selective approach to market information can help avoid excessive anxiety and prevent the erosion of passivity.

Conclusion

The concept of passive investing may seem alluring with its promise of hands-off financial gains. However, it is crucial to recognize the thin line between passivity and the mental space engaged by these investments. Acknowledging the emotional attachments, information overload, and decision uncertainties that come with passive investing empowers investors to find a more balanced approach. By adopting a long-term mindset, embracing automation, and practicing mindful consumption of financial information, investors can navigate this intricate landscape while preserving mental well-being. Ultimately, it is through this introspection and awareness that true passive investing can be achieved, albeit not without a degree of mental involvement.